Understanding how to Read and Analyse your Financial Statements

Authored by:

iClick2Learn Team

‘Click the video titles below to view them’

Transcripts are available under the videos

Keeping a watchful eye on the financial health of your association gives you the power to keep it at the top of its game. Understanding and interpreting financial reports and trends are one of the key ways you can gather information on the strengths, weaknesses, and general performance of your association.

It’s essential to have a financial reporting process in place, so that financial reports can be made available on a regular basis. Your responsibility for the financial reporting process also includes making sure effective controls and measures are in place, such as, policies and procedures. You need to allow for adjustments in your financial activity, as well as, understand what’s being reported on, such as, audit or contractual obligations which all rely on good financial literacy.

You are not expected to be an expert, but you are expected to be able to read, understand, and interpret your financial statements. In a nutshell, there are four main financial reporting statements provided at your board and member meetings. These inform you about your association’s financial position and it’s performance.

The first report is the balance sheet, also called the statement of financial position. The second report is the profit and loss statement, sometimes called the statement of financial performance. The third report, the statement of cash flows is also referred to as the statement of receipts and payments. The fourth report you should have is a cash flow forecast.

It is important that you always work with the original annual budget you started with at the beginning of the financial year. Whilst changes happen, these can be reflected in your cash flow forecast report. Having the original budget reported on means you can easily compare it to the actual figures that are emerging throughout the year. This can clearly show if original projections are on track or not or if there’s an emerging trend you need to discuss.

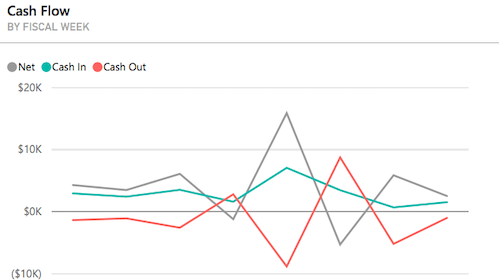

The second report, the cash flow forecast, is an important one as you’ll sometimes have more expenses than you have income, and you will need to manage this. You’ll need to predict when you need cash and how you can make sure that cash will be available to keep things on track. One of the best places to start with cash flow forecasting is the previous year’s figures.

Matching the timing of your income and expenses for the current year to those in the previous year. For example, the month your insurance is due. The forecast should also be used for long-term planning processes to ensure the association carries the cash reserves it needs at the time it needs them and to support any of your longer-term strategic objectives.

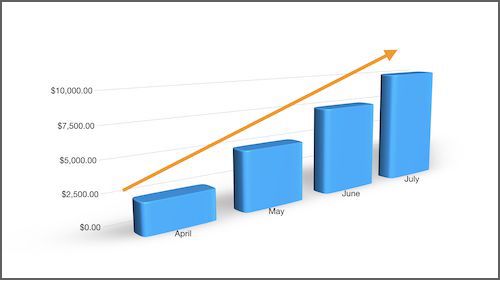

Your profit and loss statement is useful in helping you analyse trends and return on investments in your activities. A horizontal analysis looks at trends over a period of time, say three years, so you can analyse each ledger across each year and see what patterns are emerging such as a rise in utilities by 2% per annum. A vertical analysis shows you what amount or percentage each of your income areas is of your total income. For example, grants might be 25% of total income. You can also do this for expenses as well.

The balance sheet is useful for analysing your assets and liabilities. Ask questions about your assets. Are they correctly classified as current or non current? What’s the value of the assets and the method used to assess that value? Misclassification of assets can make a huge difference to your liquidity. You could believe that you’re in a more positive position if, for example, a non current asset has been classified as a current asset. This would make the report show that you can pay off your short term liabilities and you’re not insolvent, when that may not be the case at all.

Making sound decisions about finances and planning activities should be based on a sound understanding of the information available to you. Having enough knowledge on financial matters means you can ask questions about what is happening and what your service needs to plan for. It’s a good idea to familiarise yourself with the four most common financial reports and what they’re telling you, as well as understand the nature of the treasurer’s report. Let’s look at these reports and explore what their purpose is.

An annual budget is a forecasted plan for how much money you’ll bring in in the next year, where that money will come from, and how it will be spent, invested, or used. Your cash flow forecast reflects up-to-date changes and tells you if you’re bringing in enough money to cover what you’re spending. It calculates your receipts against your payments and indicates if you’re likely to run out of money or whether you’ll have a surplus in the future. Understanding this report is important because it helps you prevent accumulating expenses that might risk your solvency position. There are three parts to a cash flow forecast; operating activities, which are your day-to-day expenses and income, investing activities, which show information about things like the purchase of equipment, property, and investments, and financing activities, which show details of how you’re re-paying your loans and debt. Your income and expenditure statement is also known as your profit and loss statement or statement of financial performance.

It tells you exactly how much income has been received over a set period. It also shows you how that income has been distributed against the expenses required to run your service. Your balance sheet is a statement of your financial position at a particular point in time. It details what you own in assets and what liabilities you owe, and the worth of your service, also called equity. Your treasurer’s report shouldn’t need a great deal of interpretation. You should be able to look at the report and the notes to the financial reports and be able to understand the impacts and trends. It’s important to know the report should not just be transactional, telling you what happened in the past.

The report should also focus on analysing how these transactions impact decision-making and provide recommendations on what your committee needs to consider moving forward. One great tool to help reporting is a dashboard report. It helps you track key trends in areas you want to monitor. For example, if you want to track weeks of working capital, currently it might be eight weeks. You can compare that to the same period last year. This shows you’re doing better than last year, but you still have some work to do to achieve this year’s goal. The dashboard report is a good summary report that can use graphs, trend diagrams, and pie charts, as well as tables.

Related posts

Developing a Fundraising Plan

Create a Sponsorship Plan

Develop Your Event Plan

Approving Your Budget

Top 10 tips for your grant budget

3 Essential Financial Documents

Staying On Top of Your Financials

What is Auspicing?

Understanding Common Financial Reports

Finance Basics

Financial Controls That Protect you and Your Organisation

What are Audits and Which one do I Need?

Why you Need Financial Reports to Help Make Decisions

Forecasting your Financial Future is the key to Financial Success

Monitoring your Financial Position

Financial Controls

Understanding your Balance Sheet

Paying Committee Members

Key Financial Terms

How to Assess your Financial Health

- Tags | Accounts, Budgeting, Financials