Understanding Common

Financial Reports

As a committee member, you should regularly review financial reports and statements.

Authored by: iClick2Learn Team

Translate Text

Table of Contents

Introduction

You joined the committee of your local not-for-profit, to help out, not read financial reports. I get it. You want to get on with helping your committee and organisation.

However, all committee members are responsible for good governance, so you need to be aware of your organisation’s financial situation.

This article will explain, in easy to understand language, some main financial reports and controls you should read and understand. You’re not expected to be an accountant or math whiz, just to be able to identify if something doesn’t look right.

Annual Budget

The annual budget is created before the start of the new financial year. You should consult the previous year’s budget when creating the current one. This will serve as a guide to your expected expenses and incomes.

Essentially, a budget is a list of expected income and a list of expected expenses. If your expenses are more than your income, you will need to find ways to lower your expenses.

Income can include things like:

- Membership fees

- Annual fundraising events

- Grants

And expenses can include things like:

- Rent

- Insurance

- Catering

Your budget should be aligned to your purpose and any longer-term goals or strategic directions.

For example, if your goal is to help the vision impaired, holding a foreign language film night with subtitles, might not be the best even to spend money on or use as a fundraiser.

You should develop a budget as a committee. Don’t leave the Treasurer to do all the work alone. It’s important to involve everyone on the committee so they have a good understanding of the figures, directions and rationale.

Once the budget’s been drafted, it should be presented to the committee for approval.

With an approved budget, you’re also in a stronger position and ready for any grant opportunities that come your way.

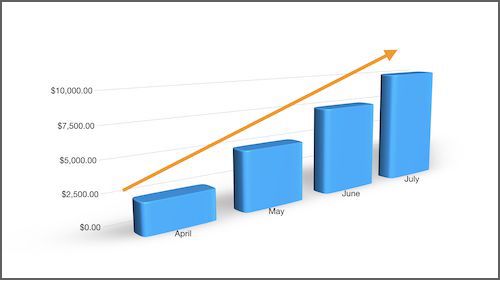

Once it’s in place, you should get a regular report showing you the comparison of the projection versus the reality actual.

For example, if you budgeted $500 for catering, but the actual cost was only $400, that should be reflected.

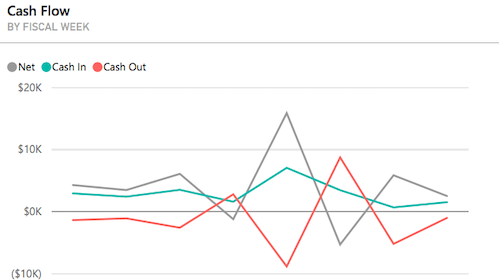

Cash Flow Forecast

Cash flow, simply means the flow of cash into and out of your organisation.

As most organisations work with a combination of cash, cheques and invoices, there is likely to be a lag when money is owed and money is received. This is why it’s important to forecast and review expected cash inflow and outflows in this report.

This report will help your committee form a clear and current picture of your financial situation.

Some cash inflows to consider include:

- Membership fees

- Investment returns or bank interest

- Successful grants or sponsorships

- Fundraising forecasts (refer to previous fundraisers, and be conservative)

- Sales of goods and services

Some cash outflows to consider include:

- Insurance

- Rent payments

- Payments to suppliers (eg catering)

- Staff salaries (if applicable)

- Purchase of any new assets (eg coffee van for fundraising)

- Loan repayments

- Consumables (eg paper, stationary)

Financial Controls

The term financial controls can sound more like something from the corporate world then something you’d have to worry about at your not-for-profit.

What it really means is that whatever the size or legal structure of your organisation, you need some systems and procedures in place to manage your finances.

Financial controls give your committee guidelines on what needs to be considered in making financial decisions.

Your committee has been given the power by your members to govern and manage the finances, and this is where financial controls come in.

Here is a list of financial controls to keep your organisation accountable and transparent in all it’s financial dealings.

- Conflict of interest policies

- Asset and property records

- Annual review/or audit of your organisation’s financial records

- Clear policies for funds received and spent by the organisation (including petty cash, cash payments, accounts receivable and payroll)

- Regular financial reporting to committee and members

- Organisational and committee reviews

Balance Sheet

The balance sheet provides a picture of the financial health of an organisation at a given moment often monthly or quarterly.

It lists in detail the various assets that the organisation owns, its liabilities and the value of the organisation’s equity (or the net worth of the organisation).

Assets are what the organisation owns, for example, a building or equipment

Liabilities are what the organisation owes, for example, utility bills, rent or bank loans.

Equity is cash in the bank, money on hand, or the worth of any assets minus liabilities.

A balance sheet will minus your liabilities from your assets to determine the net worth of your organisation (equity status).

This report is particularly important to not-for-profits, to ensure you remain solvent and can continue operating. Insolvency happens when you have more liabilities than assets.

Items on your balance sheet can include:

Assets – cash, investments, inventory, land, buildings, equipment, machinery, furniture, patents, trademarks, and money due from individuals or other businesses (known as debtors or accounts receivable).

Liabilities – debts, loans, credits, general expenses

Equity (or net worth) – money raised from memberships, fundraising, grants etc. It can also include equity of any assets your organisation owns.

If your equity/net worth is close to zero or in the negative, this is a sign your organisation is unable to pay its debts and is at risk of being insolvent. If this is the case in your organisation, you should contact a professional.

Conclusion

It is the joint responsibility of the committee, to ensure your organisation is financially viable. As a committee member, you should regularly review financial reports and statements. If you are concerned about the financial health of your organisation you should consult a professional such as an accountant.

Related posts

- Tags | Budgeting, Financials