How to Assess your Financial Health

Authored by:

iClick2Learn Team

‘Click the video titles below to view them’

Transcripts are available under the videos

Regularly assessing your financial statements is important for the health of your association’s financial position, it’s just like keeping on top of your physical health, it means that you can address problems in the early stages and it gives you the ability to make adjustments if you find things aren’t going quite as planned. In this video, we’re going to talk about two ways of assessing your financials.

The first is a ratio analysis, one of the most common methods showing indicators of financial health. There are a number of ratios you can use, we’re going to talk about the most popular ratio that tells you how easily and quickly your association could turn assets into cash, it’s called current ratio, sometimes also called the liquidity Or quick ratio This ratio is calculated by dividing the current assets by the current liability amounts from your balance sheet. Current is based on 12 months. So, current assets often called liquid assets can turn into cash within that time, while current liabilities need to be paid within the 12 month period.

Non current are those that are expected to take longer than 12 months. So, to calculate the current ratio, we’ll divide the total current assets by the total current liabilities, this gives us a result of 0.82. What this means is that you only have 82 cents of current assets to cover for every $1 of current liabilities you own. Is this a concerning position? Well, it certainly could be. On paper it seems that you’re in a negative cash position, which is one indicator of potential insolvency. And you also don’t appear to have any working capital available to use either. However, there could just be a delay in income being received. You might find the next month, you’ve got $2.50 in current assets for every $1 you own. Another way to help you determine if it’s good or not, is to use benchmarks. For example, let’s look at the ratio result of 82 cents.

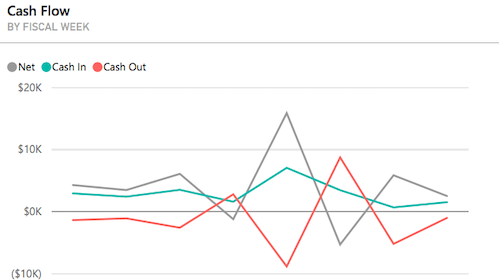

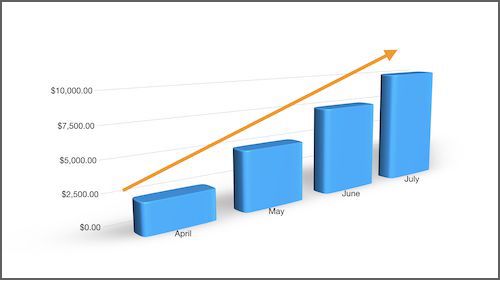

If you knew that the benchmark of 82 cents to $1.20 was the average liquidity range expected, then perhaps that’s not as much of a risk as you initially thought, you could also analyse the health by comparing your results to the same period last year, or perhaps an average over two to three years. One thing to also check is if the assets and liabilities have been correctly classified, having non current assets classified as current assets can completely change your solvency position. The second white to quickly assess your financial health is to use a dashboard. It’s just like the dashboard in your car, it’s a visual summary giving you up to date information on what’s happening. The important thing in setting up a dashboard is that it must present proper measures in relevant terms that are meaningful to your association’s risks and goals.

It’s important to realise that it’s just there to support your understanding of progress and trends. It’s not there to substitute your duty of care to analyse the more detailed financial reports. In this lesson, we’ve covered the basics of analysing your financial position, using ratios and the benefits of using a dashboard to monitor your association’s activity and direction.

Regularly assessing your financial statements is important for the health of your association’s financial position. It’s just like keeping on top of your physical health. It means that you can address problems in the early stages and it gives you to ability to make adjustments if you find things aren’t going quite as planned.

In this video, we’re going to talk about two ways of assessing your financials. The first is ratio analysis. One of the most common methods showing indicators of financial health. There are a number of ratios you can use. We are going to talk about the most popular ratio that tells you how easily and quickly your association could turn assets into cash. It’s called current ratio. Sometimes also called the liquidity or quick ratio.

This ratio is calculated by dividing the current assets by the current liability amounts from your balance sheet. Current is based on 12 months. So current assets often called liquid assets can turn into cash within that time, where current liabilities need to be paid within the 12-month period. Non-current are those that are expected to take longer than 12 months. So to calculate the current ratio, we’ll divide the total current assets by the total current liabilities. This gives us a result of .82. What this means is that you only have 82 cents of current assets to cover for every one dollar of current liabilities you owe. Is this a concerning position? Well, it certainly could be.

On paper, it seems that you’re in a negative cash position, which is one indicator of potential insolvency. And you also don’t appear to have any working capital available to use either. However, there could just be a delay in income being received. You might find the next month you’ve got two dollars and 50 cents in current assets for every one dollar you owe. Another way to help you determine if it’s good or not is to use benchmarks. For example, let’s look at the ratio result of 82 cents.

If you knew that the benchmark of 82 cents to one dollar and 20 cents was the average liquidity range expected, then perhaps that’s not as much of a risk as you initially thought. You could also analyse the health by comparing your results to the same period last year or perhaps an average over two to three years. One thing to also check is if the assets and liabilities have been correctly classified. Having non-current assets classified as current assets can completely change your solvency position.

The second way to quickly assess your financial health is to use a dashboard. It’s just like the dashboard in your car. It’s a visual summary giving you up-to-date information on what’s happening. The important thing in setting up a dashboard is that it must present proper measures, in relevant terms that are meaningful to your association’s risks and goals.

It’s important to realise that it’s just there to support your understanding of progress and trends. It’s not there to substitute your duty of care to analyse the more detailed financial reports. In this lesson, we’ve covered the basics of analysing your financial position using ratios, and the benefits of using a dashboard to monitor your association’s activity and direction.

Related posts

Developing a Fundraising Plan

Create a Sponsorship Plan

Develop Your Event Plan

Approving Your Budget

Top 10 tips for your grant budget

3 Essential Financial Documents

Staying On Top of Your Financials

What is Auspicing?

Understanding Common Financial Reports

Finance Basics

Understanding how to Read and Analyse your Financial Statements

Financial Controls That Protect you and Your Organisation

What are Audits and Which one do I Need?

Why you Need Financial Reports to Help Make Decisions

Forecasting your Financial Future is the key to Financial Success

Monitoring your Financial Position

Financial Controls

Understanding your Balance Sheet

Paying Committee Members

Key Financial Terms

- Tags | Budgeting, Financials