Forecasting your Financial Future is the key to Financial Success

Authored by:

iClick2Learn Team

‘Click the video titles below to view them’

Transcripts are available under the videos

Financial forecasting is different from budgeting. Budgeting is done in advance, a prediction of what should happen. Forecasting is a process of aligning what you predicted to happen and what is actually happening and making adjustments along the way to keep things on track for the future. A forecast is essentially a budget that’s been amended to reflect actual events as they occur. Some might actually call it a live or updated budget. By keeping your budget exactly as it was approved with no changes or updates, you can then use this to benchmark against the final forecast result at the end of the financial year. This is a great analysis tool to help inform decisions around financials for the forthcoming year.

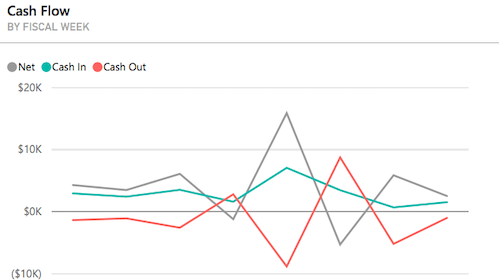

You won’t have the ability to compare projected versus actual figures if you merge your starting budget with your forecasting processes. The two forecasts used by most associations are the income and expenditure forecast and the cash flow forecast which is different from the statement of cash flows previously discussed. The first of these reports, the income and expenditure forecast is usually done at the end of the month when the figures are available to work with. Any variations from the budget are noted and the impact of these differences is explained. Management will then assess how this impacts the overall outcome and either recommend or make appropriate adjustments. The second report, the cash flow forecast is an important one as you’ll sometimes have more expenses than you have income, and you will need to manage this. You’ll need to predict when you need cash and how you can make sure that cash will be available to keep things on track.

One of the best places to start with cash flow forecasting is the previous year’s figures. Matching the timing of your income and expenses for the current year to those in the previous year. For example, the month your insurance is due. The forecast should also be used for long term planning processes to ensure the association carries the cash reserves it needs at the time it needs them and to support any of your longer term’s strategic objectives. In this video, we have covered why financial forecasting is important, the difference between budgeting and forecasting, and the two types of forecasts you may want to review.

Financial forecasting is different from budgeting. Budgeting is done in advance, a prediction of what should happen. Forecasting is a process of aligning what you predicted to happen and what is actually happening, and making adjustments along the way to keep things on track for the future. A forecast is essentially a budget that’s been amended to reflect actual events as they occur.

Some might actually call it a live or updated budget. By keeping your budget exactly as it was approved with no changes or updates, you can then use this to benchmark against the final forecast result at the end of the financial year. This is a great analysis tool to helping form decisions around financials for the forthcoming year. You won’t have the ability to compare projected versus actual figures if you merge your starting budget with your forecasting processes.

The first of these reports, the income and expenditure forecast, is usually done at the end of the month when the figures are available to work with. Any variations from the budget are noted, and the impact of these differences is explained. Management will then assess how this impacts the overall outcome and either recommend or make appropriate adjustments.

The second report, the cash flow forecast, is an important one as you’ll sometimes have more expenses than you have income, and you will need to manage this. You’ll need to predict when you need cash and how you can make sure that cash will be available to keep things on track.

One of the best places to start with cash flow forecasting is the previous year’s figures. Matching the timing of your income and expenses for the current year to those in the previous year. For example, the month your insurance is due. The forecast should also be used for long-term planning processes to ensure the association carries the cash reserves it needs at the time it needs them and to support any of your longer-term strategic objectives.

Related posts

Developing a Fundraising Plan

Create a Sponsorship Plan

Develop Your Event Plan

Approving Your Budget

Top 10 tips for your grant budget

3 Essential Financial Documents

Staying On Top of Your Financials

What is Auspicing?

Understanding Common Financial Reports

Finance Basics

Understanding how to Read and Analyse your Financial Statements

Financial Controls That Protect you and Your Organisation

What are Audits and Which one do I Need?

Why you Need Financial Reports to Help Make Decisions

Monitoring your Financial Position

Financial Controls

Understanding your Balance Sheet

Paying Committee Members

Key Financial Terms

How to Assess your Financial Health

- Tags | Accounts, Budgeting, Financials