Top 10 Tips for Your Grant Budget

Learn the basics of creating a budget for your next grant application.

Authored by: Kylie Neary

Translate Text

– So, welcome, everyone. Thanks for joining us today. So I’m Kylie Neary. I’m a career accountant and have worked in the not-for-profit space for the last seven or eight years. So our agenda for today, we’re going to identify the budget requirements through the criteria in the grant, how to create a simple draught budget, some of the terminology that’s often used in the budgets, items that are often ineligible with applying for grants, some guidelines around particularly insurance costs, GST, and taxes, and also probably what you’re most excited about is the top 10 tips for grant presentation.

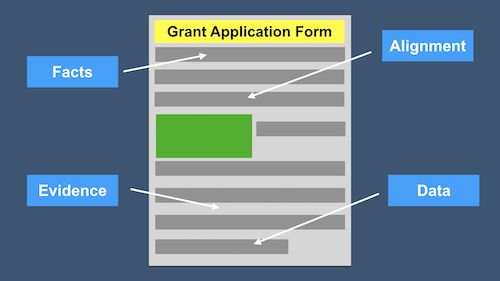

So I hope that there’s some good ones there for you that you can take away from today. So I’d like to start off with acknowledging that we are streaming today from the land of the Awabakal and Worimi peoples. I also acknowledge the traditional custodians of the various lands on which we all work, and the Aboriginal and Torres Strait Islander people participating in this workshop today. I acknowledge our past, present, and future Aboriginal and Torres Strait Islander people. So the most important things to do is to check that you qualify for the grant. So with a grant, they will often have criteria for you if you are relevant to apply. So the first thing to do is to make sure you do go through the grant and complete the checklist in making sure that you do qualify. There’d be nothing worse than spending your time on going through and preparing grant, only to submit it and be rejected and unsuccessful because you don’t qualify. The next thing is read the whole document. It’s really important that you do read the document and through doing that, while you’re reading through it, highlight anything that is relevant for you to complete the grant, any questions that you may have in reading through it and understanding that further for yourself, and if you’re unsure of any aspect, then go back to the grant sponsor and ask them clarifying questions around those things and what those questions are and get their response for them. So along with the checklist and making sure that you do qualify, there’d be nothing worse than also submitting and misunderstanding a particular point of the grant and then being unsuccessful in relation to that. So today was just to look at a simple draught budget and given that you are all experienced, this may be a little bit simple for you, so, and we may flush out some things in the questions, perhaps in the specific questions that you do. And Nicholas, thanks. You’ve already provided some questions. So we’ll see whether we do have some time to answer those. So what I’ve done here is I’ve prepared a table of what I say would be the items that you should look at in preparing your grant submission. My favourite thing to do with preparing a grant is actually to have a look at, is to use Excel. The benefits of using Excel is that you can put in formulas to check your additions because you really don’t want to make a mistake with your submission. And I’m going to assume, if you’re all experienced grant users, that you are experienced with using Excel. Show of hands, Nicholas and Sue, that you’re good with Excel. Great. So in this template that I’m showing, we look at the item, the justification, the costs, the quantity, the total, and the supporting information that you may have. So all grants are different and so that’s why it’s important that you’re looking at. So for this one, I’ve assumed that it’s a grant that we’re applying for that is some workshops. So the consultant that we’re going, so our item is a consultant. Our justification is iClick2Learn because they would be the best consultants around in applying for any grant. Their cost is $200 an hour, which I’ve just made up. We haven’t confirmed that if that is their hourly rate. They’re going to take three hours to prepare the workshop for us, so that’s going to give us a total of $600. They provided us with a quote for that so we can go back and refer to the quote for them. Then there’s resources for the workshops, which was a total of $1,000, which was also provided in the quote from iClick2Learn. I need to travel to complete these workshops because we’re out of lockdown and we can actually get around and attend these workshops that they’re going to deliver, so it’s $500 and it’s based on the kilometres to travel to the workshop at a dollar per kilometre. We’ve also allowed a per diem for meals while travelling at $50 a day and there was five days of workshops. So that gives us $2,350. Now, one of the questions that you asked, Nicholas, and have just put in a question about that later, but one of the questions asked was about a contingency and how do you allow for a contingency in preparing a budget for a grant? Because there always is the unexpected things. Sometimes in a grant, and that’ll be in the guidelines, whether there’s an allowance for contingency, and they may give you the percentage that you can put in for a contingency allowance. The other thing to do is to build the contingency into some of your detail, that you might here put in a contingency line to add up to your total. And it depends on what you’re submitting in and what the grant requirement is for what you’re submitting. If you only need to submit the $2,350, so we may put in a contingency of $500 to our supporting documentation, which gives us $2,850, or we might just bump up the resources slightly. So we can get it into our resources or the travel. We might just bump up the travel to $700, which is based on the travel to the workshops. So it’s not disallowable to do those type of things. It’s just being smart about where you can build in those contingency and in your supporting documentation, building up the cost of the grant to know where you have built in those contingencies as well. So I hope that that maybe gives you some guidelines on that. Now we’ll move on to some of the terminology that we use in applying for grants. Some of the common terminologies are acquittals, auspice, in-kind, milestones, and contingency that I’ve got here to talk about today. And I’m just going to ask you if there’s anything else that you’ve come across that I may be able to help. So an acquittal is the process of evaluating and reporting on outcomes of expenditure for the funds that have been provided to you. They’re useful ways to assess the progress of the operations, the efficiencies, and the strengths and weaknesses. Again, it’s really important to read the grant documentation carefully to understand any reporting requirements that may be required and if an acquittal statement on the finance is one of the objectives of the grants. It’s easy to track these things as you’re delivering on the grant, as the money is spent, rather than in hindsight. You also want to make sure that you’ve spent to your budget, not over or under, because both have consequences. So if you underspend on your budget, what’s the opportunity lost that you have on underspending on it, but if you overspend, then what’s the opportunity lost because it’s going to cost your organisation the amount that you’ve overspent by. Auspice or auspicing, and I’ve actually referred to a really great explanation that Nat gives on this that’s available on the iClick2Learn library. So in simple terms, it’s where another organisation supports your organisation.

And Nicholas, this might go towards the question that you had as well if there is a change in the organisation that is delivering on the grant when it comes around. So one of the most common and easy ways is where an organisation auspices where another one is applying for the grant programme. For example, your organisation has found the perfect grant, but you looked at the eligibility and need to be a charity with DGR status. You don’t have this, but you know a similar organisation that you can work with. So the other organisation would apply for the funding in their name. This would be a great solution, but it does carry risk for all partners. For example, you might not get as much funding as you would like or need to give the other organisation to cover their expenses. This may affect the quality outcomes of your programme for the other organisation. It’s in their name on the grant application. They are responsible for the administration management of the grant and for acquitting that funding. If you’re thinking about doing this, make sure you have an agreement that sets out who is responsible for what and what will happen if things aren’t working out. So, Nicholas, I guess if you knew up-front that that’s what you needed to do, you would look to get that agreement in place. If at the time that it came, you weren’t able to do it, but you knew another organisation that could deliver on the grant, you could look to do this, but I’d check with the funder to see whether that was possible and look at putting an agreement in place to put it across to them.

In-kind contributions are the donation of goods or services. So rather than receiving a cash donation, the in-kind contribution is often a service that would otherwise have to be purchased by the organisation or an item that can be put to use within the organisation. In-kind contributions are often also outlined in the criteria of the grant around whether they can be included or not. And again, it would be great if you had some kind of support in relation to the in-kind contribution that was being delivered. So in relation to a sporting club, you might have a member that is an electrician and you’re doing an extension and they agree to donate their services for doing the electrical works. So you actually want to cost that into the grant for what you’re getting for that. So they’ll ask for amounts that are in-kind and it’s really worthwhile to put in those in-kind contribution amounts that you are receiving. Milestones are events that occur or should occur at specific points in the delivery of the grant and it’s an important indicator for the progress of your project. So, again, they’ll ask whether there are milestones that are to be delivered on, depending on what type of grant that it is that you’re applying for, and it’s really great to outline these things in your application if there’s specific milestones that you would be delivering on. So contingencies, it’s allowing for the unexpected. So if there isn’t a specific allowance for this, as I said before, try and build it into your pricing. It is a judgement call, so try and make an educated guess.

So I’m just wondering if we pause for a second and if there was any other terminology that you wanted me to clarify on that you have come across. Nothing else? So if you get stuck, really great thing to do is refer back to the iClick2Learn library and do a search on the term that you may be stuck on or reach out to the funder and ask them what they meant around a specific item if you’re really not sure on what it is that they were asking about. So moving on to some ineligible items around grant funding. So some of the ineligible items that you may come across are things such as overhead costs or the rent of your premises, organisation wages, or administration fees. Again, it’s really important within the grant criteria to look and see what they may list as ineligible criteria. So it’s all about reading that documentation and seeing what they do outline that may be ineligible. Some of the things that will be in the grant may be around insurance, GST, or other taxes. They will normally outline specifically the insurance that is required. So, for example, there may be $5 million worth of public limited liability insurance requested and may also be recommended, but not be a condition of the funding that you actually are required to have that. So, for example, they may also outline personal accident and professional indemnity directors and officers insurance. You may be asked that if you have employed staff, that you comply with workplace injury and management. If your organisation doesn’t have insurances or you are unsure, I really do recommend that you engage with an insurance broker to understand your needs and the cost to your organisation.

If you’re not sure about where to even start with this, the insurances that are noted in a grant are a great place to start if you don’t have those in place to engage with a broker and see if those are the insurances that you do need and what the cost of them would be. Around GST, it will list in relation to GST if the application is GST inclusive or exclusive. So organisations who are registered for GST when applying for the funding may be specified in the grant application to exclude GST from the amount of the requested funding. GST will then be paid your organisation on top of that if you are successful. Organisations that are not registered for GST, when requesting the funding for your project, you’re required to include GST in the cost of your project budget. So ensure that when, in that instance, the quotes that you received that are inclusive of GST, because you will be charged that by the trades on the delivery of the work. And taxes, I’m assuming that we’re all not-for-profits here, so there generally aren’t other taxes, unless it maybe be payroll taxes if you have a payroll over those guidelines. So it’s just one to keep an eye out for and if it’s listed in the criteria as well. So moving onto the valued 10 top tips and maybe there might be some questions from these. It’s really important to understand if the funder is offering the grant GST inclusive or exclusive and you need to know how your organisation treats GST. Submit a realistic budget. If you don’t need the full amount, don’t ask for it. So, for example, funders find it annoying if the grant is for $10,000 and your organisation puts in an application with $9,995.95. There’s no real justification for this. It is viewed much more favourably if it is realistic. The opposite of the other side of that is don’t sell yourself short for your cause. Make sure to think of all the elements that you require for your grant and build those in with a small contingency plan. So, Nicholas, back to your point, if you can build in a contingency plan, then that’s really worthwhile. Understand and articulate your in-kind contributions and know what they look like.

So if there is that in-kind contributions, detail it out in your supporting documentation as to what they are. If there is any opportunity to highlight that you have some co-funding for the grant that you’re applying for, see if you can make note of that in the grant application. Even if it’s a small contribution, it generally really speaks to the commitment your organisation has in applying for the grant. Next, be careful with administration or overhead fees. So you need to understand what can be funded and what cannot be with realistic expectations. So some funding organisations will happily accept, for example, 15% administration, whereas others may be very resistant if there’s even a 5% administration fee put in. So it’s back to that criteria and reading the grant information to understand what they will accept. Be prepared to report on your activity and factor in those costs if needed and able to be factored in. So I suggest even a simple one or two page report would be great to set up and absolve that into your budget if you think it is going to be a time-consuming requirement of submitting that in relation to the budget. If a more detailed financial acquittal is required, especially if it’s required to be submitted by an independent accountant or auditors, you should allow for this in the budget as well. If it’s a project that goes over multi years, ensure that CPI is included for such items such as salaries and increases in costs. Next, if there is room in the application, highlight the sound financial management and governance of your organisation to the funder. They’ll often look on this favourably as well. And the last tip is there’s no such thing as free money, so be prepared to work for the grant funding through the reporting, providing good news stories, and ensuring that you have the capacity to nurture the relationship with the funder, if possible, as it can result in repeat funding for you. If you neglect the relationship and don’t deliver on what is required, the chances of future funding are often not likely. Also, don’t be afraid to raise issues relating to the delivery of your project.

Funders prefer to know early if there are problems and can even assist you with problem-solving. Getting to the end of the project and not letting the funder understand the issues related to non-delivery just doesn’t benefit anyone.

– All right, so one of the questions I have is how long will grant assistance consider required to be valid? I’ve been doing a couple of projects that have involved solar panels or building a new shed. They’re complex quotes first applied to put together and I don’t want to constantly go back to them. So is a quote that’s 12 months old going to be okay or do they really need one that’s very current, like in the last month or so?

– Yeah, so I guess the important thing for you would be, is that quote still valid from the person who provided it 12 months ago as well? That’s what you’d want to ensure. So if it was a worthwhile giving a call to the supplier to make sure that that is still the price, and then it’s going to be that communication with the funder to understand if a quote that is 12 months old, but you have confirmed is still valid, is still relevant. So I think it’s going to be a case-by-case situation and it’s about having a communication channel with the grant provider. Is that what your experience has been as well?

– We’ve put a couple of grants in where the quote has been six to 12 months old. Yes, the quote’s physically said on it it’s valid for 30, 60, 90 days, whatever, but yes, we’ve spoken to them and yes, they’ll still agree to that. We had one supplier who came back and said, no, the cost of steel’s gone up. I’ll give you a new quote. And they were quite happy to do it. I’m just concerned that I don’t want to be going back every five minutes ’cause I’m putting in lots of grants for the same project to different organisations, trying to get funding, that I don’t want to be annoying my suppliers by the time I get the money that they won’t to speak to me anymore. So, yeah, just making sure that the quote can be kept for a little while.

– Yup. Yup. Maria’s just asked a question on the chat. What fees could you add into your submission, for example, part of the insurance, part of phone charges, and what proof can you use if the center’s insurance and phone calls will normally be paid, but the costs will go up if you were successful with the new project? So, Maria, great question. My experiences that in doing that would be to put in an allowance for the phone costs with delivering of the grant. So put those in as line items if you’re able to because yes, they will normally be paid for, but they’re going to go up with the grant. So it is an implication of delivering on the grant that you’re going to have those increased costs. So I would build them into your costs. But just again, I can’t reiterate it enough, I feel like I’m on repeat with this, is checking your criteria to see that it does allow for those type of costs. Nicholas, I think that there was another aspect of your question as well.

– Yeah. How do we allow for price fluctuations? Like originally had a grant, we had a price increase of a mere dollar on an item, but I had 100 of those items in the graph. So it was suddenly $100 extra we had to find. The quote was valid at the time we put it in. Everyone knows grants take between three to six months to be approved by the time you get the money. So how do you allow for that sort of thing? And it wasn’t an item we expected to go up, but it was also a COVID thing in this particular case. But yeah, how do you account for that if you can’t have an actual contingency built in?

– Yeah. Difficult one given timing that it can take. And it’s just been such an overuse of term as well, but unprecedented times that we’ve had over almost the last two years now, with these changes in pricing and fluctuations and different things that we have had to factor in. In this example, did they actually ask for the quote as supporting evidence for the grant that you applied for?

– Yes, there were quotes. To be honest, the item that we actually did was a Bunnings item. It was 100 folding chairs. The price had been stable for two years. I’d been looking at this project for quite a while. Let’s say it was $20, but because if we were just getting stuff in the country, everything went up a dollar. So, yeah, it wasn’t a formal quote for that particular item, but I did have others. It was built into a quote.

– So a couple of avenues you can take. Go back to the funder, explain what’s happened, and that the additional $500 is not able to be matched by your organisation if you can’t find that additional $500 for the item. And great that you’re so on top of it that you’d know that it’s gone up by that much. And then if there just is that possibility of building in the contingency at the start. So it’s either try and build in some form of contingency for these unexpected things that happen, or by the time the grant is approved and prices have changed, can we go back and ask them for an increase in the funding?

– Are funders often willing to do that if it’s not a huge amount of money? Or it depends on the funder, I suppose.

– Depends on the funder and it really depends on the funder. It’s not often you see them actually increase. They normally have their budgets that they’ve allocated for the grants as well. So it’s just going to be case-by-case.

– Yeah. But one of the solutions we were looking at, we found savings elsewhere. Something came in a lot cheaper than we anticipated. So we were able to do it there. But one of the options was rather than going with 100 chairs, we would’ve gone with 80.

– I was just going to say.

– But that was plan B.

– I was just going to say that as well. It was just like going through my mind. I said, well, if you just reduce the number of chairs, you could also nearly get the saving.

– Yeah

– Yeah, yeah. So it’s being, yeah, it’s being judgmental about it, like where can you get it from? But that’s a great practise that you’ve had across your budget to know that as well.

– So as sort of an aside to that, let’s say we’ve gone with company A and got a quote. We were really happy with it when we put the grant in, but we’ve now found that company B can do the same or similar project for half the price. Do we have to use the company that supplied the quote if we’ve put that in?

– No. No, because your contract with delivering the grant is to deliver on the 100 chairs and the service that they were going to provide for you and then it’s up to you to source within that budget. So if you can find another contractor that you haven’t made a commitment to or locked in that particular contract with your organisation, you can change. Yes.

– Yep.

– So we did talk about how to hide some small contingencies, so it’s a judgement call. Try and be clever about how you build something in. But I really do recommend that if you can build in a contingency, it’s a great thing to do.

– Not really a question, just probably something that really springs to mind for me as you mentioned the GST. That can have really serious implications for not-for-profits and net because I’ve had successful grants where it takes them over the 150,000 threshold. Suddenly they have to register for GST. They don’t have the setup, the financial software and all the intricacies or someone to do it. So I’ve just found, in some cases, it’s really, really, and some funding bodies won’t give you the GST if you’re not registered. They won’t pay the GST. So if you’re not registered and you go for a $40,000 grant, you’re up for $4,000 in GST that you’re paying the suppliers and a lot of funding bodies don’t understand that it can be quite, just a simple $40,000 grant, you have the GST that can cripple an organisation. So, yeah, it’s just a bit of a minefield there.

– Absolutely. And one of the ways to try and anticipate that would be putting into your forecast for your organisation for the 12 months. Like, is it going to tip you over, that if you were successful, is it going to tip you over? And then seeing whether you do need to maybe put in for your GST registration in anticipation of being successful, and then you’re going to be applying including GST and get the grant, which will include the GST as well, because yes, they won’t provide you with the price with a grant including GST if you’re not registered for GST.

– Yeah, that’s right. Yeah.

– So it would be around your forecasting around what is the implication for the organisation total for the year, which then if you don’t get it next year, you’re then registered.

– I mean, that’s the problem. I’ve registered and I’ve got to do the paperwork.

– Yes, yes. Yeah, exactly.