Community Learning Library

Whether you’re a first-time volunteer or board member looking for a place to start or a seasoned community member looking to advance your skillset, this Community Learning Library is for you. You’ll get a comprehensive library filled with training webinars, templates, videos and access to exclusive content to get started right away.

Click on the menu below to jump to the section on this page

Quick Search

Upcoming Online Workshops

Applying for a Grant? Ask our grant expert your questions. April 30

Organiser

-

Natalie Bramble

Are you thinking of applying for a grant?

Or, In the middle of writing your grant application?

This is your chance to ask our grant expert any questions you have about your application. This might include:

- How do I know if I’m eligible to apply?

- Should I apply for the maximum amount?

- What can I and can’t I include in my budget application?

- How do I increase my chances of winning the grant

- Why do my grant applications keep getting rejected?

- Do I have to pay tax on grant money?

- How do you do an acquittal?

Have a specific grant application you’re working on right now? Bring all your questions to this online workshop and let our expert answer them for you.

Start time 5:30pm AEDT

Topics

Boards and Committees

Discover everything you’ll need to know about how to govern and lead. From meetings to financial reports, you’ll find it here.

Events

Everything events! From starting a new event, to increasing sponsorship and attendees to managing your team and budget.

Financials

Financials aren’t scary or boring! Simple effective learning that helps you better understand this unnecessarily complex topic.

Fundraising

From useful ideas to help you think through your approach, to specific topics like developing your crowdfunding campaign.

Grants and Tenders

One of the most important things any community organisation needs to do. From simple tips to strategic approaches increasing your chances.

Marketing

From fundamental principles to tools and templates that help you build your audience; supporters and grow your organisation.

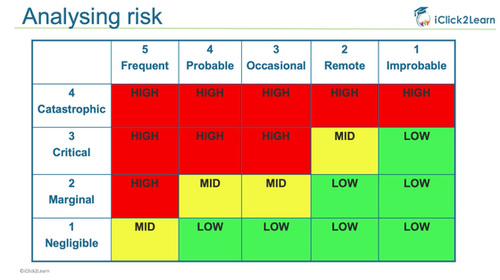

Risk Management

Risks are everywhere and can be managed well, with the right approach. Learn practical approaches to managing risks.

Volunteers

Many of us wouldn’t be here without them! Learn how to start, build, engage, leverage and manage your wonderful volunteers.

Covid -19 Toolkit

A toolkit to help your community organisation navigate the world of working from home and service planning during COVID-19.

Planning

Strategy and action deliver results and plans are the foundation for achieving your goals. From strategic plans to business plans and everything in between.

Personal Development

Explore topics from self management to self-care. We all need support to develop our personal skills and attributes that help our not-for-profit and our community.

Child Safety

Courses

Introduction to Grant Writing [Course]

How to Develop a Logic Model [Course]

Deductible Gift Recipients Status [Course]

Questions to Ask Your Board [Course]

How to Create an Annual Communications Plan [Course]

Strategic Planning [Course]

Volunteering During COVID [Course]

5 Step Formula To A Winning Submission [Course]

Volunteering 101 [Course]

Volunteer Induction [Course]

Your Easy Stakeholder Communication Plan [Course]

Avoid the 6 Common Mistakes Submission Writers Make [Course]

The Ultimate Guide to Choosing a Web Designer [Course]

7 Tips to Deliver Events on a $0 Budget [Course]

7 Steps to Marketing Your Organisation [Course]

What's New

Introduction to Grant Writing [Course]

Accidental Counsellor

How to Get Volunteers More Engaged Post-Covid

What is a Volunteer Manager?

Building a Culture That Encourages Volunteers

Create a Sponsorship Plan

Developing a Funding Ready Project

Develop Your Event Plan

Volunteer Interview

Risk Management

Frequently Asked Questions

Your dashboard shows you information unique to your membership.

Wherever you are on the website, you can always select My Dashboard from the link at the top right of the page, or the top left if you are inside a course to bring you straight back to your dashboard.

To return to your dashboard later if you leave the website, either go to iclick2learn.com.au/login, or go to iclick2learn.com home page and select ‘LOGIN” from the top left of the page, and log in with your username and password. If you have forgotten your password, then there is a link in the login page, or at the top right side of the page.

COURSES

After you have selected the course you want to take, the next page will be the course start page. Select the ‘START COURSE’ button to enter the course.

Once you have completed the individual lessons, select the ‘MARK AS COMPLETE’ button, then ‘NEXT LESSON’ button to continue through the course. You will notice the circles in the left hand lesson menu change from hollow to full when you complete the lessons. This is helpful to see your progress, as well as if you need to come back later and resume the course.

When you complete all lessons in a course, you will be automatically redirected back to your dashboard again.

To log back in to access your hub to access your learning materials, go toiclick2learn.com.au and select ‘Login’ from the top navigation menu. Or you can log in using this linkiclick2learn.com.au/login and you can add your username and password and you will be redirected to this page. There will also be a link to login in the email you received when you first signed up.

If you need to resume any courses you have already started, then go to ‘My Profile’ section on this page and select ‘Course Progress’ and you will see your courses and the progress through those courses. You can select the course and you will be directed to resume your course.

| Quality | Required Minimum Bandwidth |

| 240p | 500 kbps |

| 360p | 1 Mbps |

| 720p | 3 Mbps |

| 1080p | 7 Mbps |

| 2K | 12 Mbps |

| 4K & up | 22 Mbps |

There are various ways to quickly find resources. On the dashboard page, you can select the topic you are interested in. This takes you to a page with a list of resources sorted by delivery type (videos, articles, interviews or courses). You can also search by words using the Quick Search function at the top of this page and select ‘Search’ and it will take you to a new pages showing content related to that search. You can view the courses in the carousel on this page under courses, or see what resources are popular, under ‘Popular heading on this page. When you are on n individual page, you will see a list of ‘Related Topics’ and resources under the information.

If you would like to suggest a topic or resources we haven’t yet done, please send us your thoughts using the ‘Contact Us’ section on this page.

If you want to know how long you have access to all of your resources, then go to the ‘My Profile’ section on this page and select ‘My Account’ where you will be able to see how long you have access under the ‘Expiration’ section.